Listen now on Apple, Spotify, and YouTube.

In today’s fast-moving world, staying ahead of market trends is crucial—and that’s exactly what we deliver in this, The Market Pulse Newsletter. Timing is everything. Even the best investment idea can be worthless—or worse, costly—if the timing isn’t carefully calculated. Whether it’s cryptocurrency movements, groundbreaking tech developments, government financial shake-ups, or real estate insights. The intention of this is to bring you unfiltered unbiased updates in real time!

Here is a breakdown of what I will be covering:

💸 Bybit’s $1.46 Billion Crypto Heist – A record-breaking crypto breach shakes investor confidence. Could this be the wake-up call exchanges need?

📉 Bitcoin’s Market Shake-Up – After a parabolic rise, Bitcoin is seeing a major correction. What’s next for crypto?

🏛️ The Doge Department Exposés – Elon Musk’s latest initiative reveals shocking levels of government waste. What does this mean for taxpayers and the dollar?

🔬 Quantum Computing’s Breakthrough Moment – Microsoft’s Majorana 1 chip is redefining AI and computing—how will this reshape the tech industry?

🏡 Real Estate in 2025 – With interest rates unlikely to drop soon, what should homebuyers and investors expect in the housing market and interest rates?

Bybit’s $1.46 Billion Crypto Heist

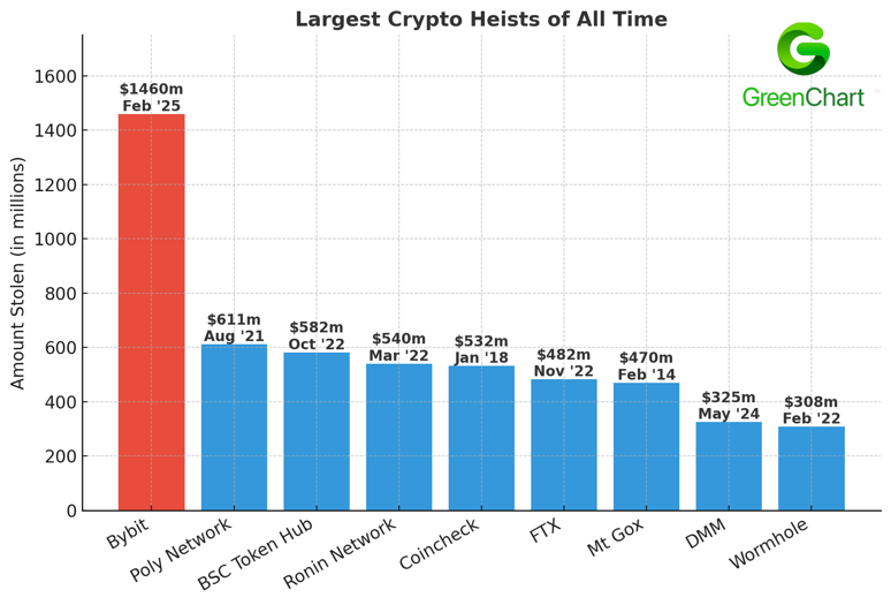

As Bitcoin adoption continues to rise, the journey remains nothing short of a roller coaster. Volatility has always been an inherent part of this emerging asset class, and while expected, it still catches investors off guard. This week was no exception, as Bitcoin faced a sharp correction following a record-breaking $1.5 billion hack of Bybit, a Dubai-based cryptocurrency exchange. The FBI has attributed the theft to North Korea’s sophisticated cybercrime unit, known as the Lazarus Group, marking it as the largest heist in crypto history—surpassing the previous record of $611 million stolen from Poly Network.

Green Chart- Image of Largest Crypto Heists of All Time

The FBI has labeled this form of North Korean cyber activity as "TraderTraitor", warning that the stolen assets are being rapidly converted into Bitcoin and other virtual currencies, dispersed across thousands of blockchain addresses, and laundered into fiat currencies. This revelation has heightened concerns about the security of centralized exchanges, triggering mass withdrawals from ETFs and reinforcing skepticism about exchange vulnerabilities.

While Bitcoin’s core protocol remains untouched, the attack underscores the urgent need for stronger security measures in crypto platforms. Many exchanges continue to rely on outdated safeguards, making them prime targets for social engineering and advanced malware attacks—tactics that have become hallmarks of North Korea’s cyber operations. However, this crisis could serve as a catalyst for improved security protocols across the industry. Enhanced regulations, multi-signature authentication, and cold storage solutions are likely to become more widespread, bolstering investor confidence.

Bitcoin’s Market Analysis (updated 3/3/2025)

Highlights:

1.46 billion dollar Heist drops Bitcoin price

Bitcoin drops below $79,000

Bitcoin erases 50% of its recent gains from $52K to $109K.

Institutional investors pull $937.90M from Bitcoin ETFs in a single day.

MicroStrategy’s latest Bitcoin purchase failed to boost price.

Is now the time to scale back into Bitcoin?

As previously discussed, Bitcoins price is falling and much due to negative market sentiment caused by the recent Bitcoin Heist. As you can see in the image around 50% of the last 7 months gains were wiped out in just a few days following this attack. Many are left wondering will this bear market continue or if now is the time to start buying it back. I will provide some very insightful information to help you make a better educated decision but please remember to still do your own research as this is only for education purposes.

Green Chart- Image of BTC-USD 50% retracement as of 3rd Mar 2025

Now as we look at Bitcoin over a long period of time this recent drop is nothing out of the normal. In fact, it is very much inside the past bitcoin cycles regarding the halving cycles and parabolic cycles of the past. However, this recent shift in price has brought Bitcoin to a very vulnerable place from a technical stance. It entered what I call “No Man’s Land” and then today just jumped back out. This “No Man’s Land” term is a term that can refer to an area with no rules, or a situation without clear jurisdiction and likewise this area of price between $73,000 and $88,000 is not a place the price or investors know what to do because of the lack of price action from the past. You can clearly see back in November that the price climbed so fast so high that there was no price action for investors to reference strong support or resistance. So what typically happens in these cases is once in this price zone we often see the same movement in the opposite direction at about the same amount of speed. This may create a short-term bearish sentiment scenario, while the values and long-term outlook of bitcoin is bullish for end 2025.

So, if this bearish trend continues there is very strong support at $73,000. This support would be much better timing to scale back in however the price may never get that low. For this reason, a more sectional scaling would be appropriate to possible buy back in at three different levels. Around $85,000, just below $80,000 and lastly just below $75,000. This allows you to buy some now and if the price doesn’t reach the later you at least got in a Low/Low. Waking up today obviously makes this a little more difficult with the price around $90,000 again. However I would not be surprised to see the price go back into this zone which is good if you are wanting a discount to today's price.

Green Chart- Image of BTC-USD No Man’s Land

Institutional Activity

The large ETF outflows suggest institutional sentiment is shifting, adding pressure to Bitcoin’s price action. Experts across multiple investment firms are betting on a $70,000 drop. With this we have seen a $1 billion outflow from ETFs and a likely transition to the futures market until the next bull run presents itself.

MicroStrategy Inc HODL

MicroStrategy continues to purchase Bitcoin in the midst of this short-term bear market and will continue to HODL. In fact, as of Feb. 17, the company said it owned 478,740 bitcoins, which were purchased for a total of $31.1 billion and an average price of $65,033 per bitcoin. Michael Saylor, Former CEO of MicroStrategy, has predicted in recent days that he believes the price of Bitcoin could soar to $13 million per unit. This is likely why there was no hesitation to buy at recent bitcoin highs around $100,000 a coin.

Key Takeaway: Caution Before Scaling In

A strategic approach would be to add positions incrementally for every $3,000–$5,000 dip below $88,000 while monitoring sentiment.

If Bitcoin goes above $95,000 by Wednesday March 5th the bear case could be invalidated.

This is not trade advice but for educational purposes only. Do your own research.

The Doge Department and Government Spending Exposés

Next, we turn to The Doge Department—why? Simple. The U.S. dollar is losing value, and as of August 29, 2024, the U.S. credit rating was downgraded from AAA to AA+, making U.S. Treasury notes and the dollar less attractive on the global stage. In response to a deepening debt spiral—one we may never have been able to escape—DOGE is the only thing I’ve seen that might actually have a chance to save the dollar and our existing financial system.

That said, what’s happening right now affects everything tied to interest rates and the dollar. Markets like FOREX, where USD is a key player, are already feeling the impact. Over time, the policies and adjustments being made today will shape GDP, national spending, and debt. The bond market and countless other sectors will be affected, as everything in the U.S. operates within a network effect linked to the dollar—unless, of course, it’s denominated in crypto.

Now enter Elon Musk, the face of this new department, who is committed to exposing wasteful government spending. Unsurprisingly, he’s uncovering massive amounts of taxpayer waste and fraud. Here are just some of the latest findings:

$10 billion in empty federal office buildings: Buildings that sit unused while taxpayers foot the bill.

$2 billion “misplaced” by Housing and Urban Development: The money was just found—how do you misplace $2 billion?

$20 billion sent to climate activists: Funds going to activist groups instead of direct environmental initiatives.

$40 billion in federal credit card spending: More credit cards than government employees! Audits reveal 12% of travel charges violated spending policies.

$1.9 billion in fraud and abuse found by the U.S. Treasury with Doge’s help.

While critics argue about Musk’s role in this, one fact remains: government overspending is unsustainable. With the U.S. debt nearing $1 trillion just in interest payments, these cuts are necessary for economic stability.

What makes this initiative unique is its transparency. Traditionally, government inefficiencies are buried in bureaucratic processes, making them difficult to trace. Now, we are seeing real-time reporting on expenditures that previously flew under the radar. The question is: Will Congress act on this information, or will these revelations simply add to public outrage without policy change?

One this is certain we are at a critical moment in the US concerning our debt and dollar usage, and some experts have said we may even still be too late.

Majorana 1: Quantum Computing’s Breakthrough Moment

Microsoft just made history with the Majorana 1 chip, a quantum computing breakthrough that is shaking up the tech world. This innovation is powered by topological qubits, a concept that was only theoretical until now.

This breakthrough allows a million qubits on a single chip, unlocking:

AI learning acceleration: Faster, more efficient machine learning models.

Material science revolutions: Simulating molecular structures at lightning speed, leading to new materials and drugs.

Optimized logistics and problem-solving: A single quantum chip could optimize supply chains, space travel, and medical advancements instantly.

The impact? This could shift investment from traditional AI processing (like NVIDIA GPUs) to quantum computing stocks. Microsoft is currently the first to unlock this technology and will likely have patents and deep proprietary methods to protect competitors from cutting in line on this now 20 plus year project. The real question is value and calculating once these chips hit the market how much value they will add to the overall market. Having said that Microsoft’s stocks have been pretty sideways year to date, and seemed unaffected by this news. Some of this neutral sentiment may be that there won't even be a working prototype for a few years.

Going beyond AI, quantum computing could fundamentally change how we develop new pharmaceuticals, optimize financial models, and even stimulate economic predictions more accurately. Imagine a world where economic cycles can be modeled with near-perfect precision. That’s the future Majorana 1 is unlocking.

The State of Real Estate in 2025

The real estate market remains stable, but the big question on everyone’s mind: Are interest rates coming down? Short answer: Not today, Not tomorrow, and definitely not soon.

Current Fed rate: 4.5%

The Fed rate has declined slightly to see if monetary tightening would get inflation to target rate of 2% and as you can see in the following charts an argument to increase or at a minimum hold rates is the solution. In no case would the Feds drop rates right now unless we saw a large spike in unemployment or a large drop in CPI.

30-year mortgage rates: 6.0%–6.8%

Mortgage rates have closely followed Fed rates and future speculation on rates. The trend from August of 2022 to current is sideways and I expect this trend to continue much longer. The idea that rates will come down is not valid and many home buyers and sellers who are completely disconnected to this data we are seeing are waking up to this truth years after the trend. This awakening will likely drive those who waited on the sidelines for a miracle to finally break down and buy or sell accepting this new reality around rates.

Inflation remains above the 2% target

With home buyers putting more unneeded pressure on the housing market, the government struggling with inflation, and spending out of control. I would expect rates to remain sideways for the foreseeable future. The real estate market is adjusting to this new normal, where elevated interest rates are not an anomaly but rather a feature of the post-pandemic economic landscape. Those waiting for significantly lower mortgage rates may find themselves waiting forever, and homebuyers who adapt to this reality will be better positioned to make informed purchasing decisions.

February’s data is in, and you can see the strong increase in national list prices going up after the seasonal winter decline. The chart clearly paints a picture of the market going sideways and what we are seeing is more money for less square footage. Homeowners adjust and have to relocate, they are simply getting less for more money as their buying power has radically gone down with rates going up.

Final Thoughts

Markets are moving fast, and every week brings new innovations and surprises. Whether it’s Bitcoin’s correction, government overspending revelations, or quantum computing breakthroughs, staying informed is the key to making smart financial moves.

Share this post